working in nyc taxes

Remember that you file taxes and claim all income in the state where you reside. Ahhhhh sigh of relief.

/GettyImages-538594694-791e2c621e27472fbdf9a3f1b7cfcb67.jpg)

Benefits Of Living In Nj While Working In Nyc

Restaurant Return-To-Work Tax Credit Program Quarterly Report - Q3 2022.

. As a nonresident you only pay tax on New York source income which includes earnings from work performed in New York State and income from real property located in the. July 29 2021 135 PM. Working In New York City Taxes.

Also in addition to state taxes New York City imposes a city tax on its. Assuming that you are physically working in Massachusetts not telecommuting you have to file two state tax returns a Massachusetts nonresident tax. People trusts and estates must pay the New York City Personal Income Tax if they earn income in the City.

New York Tobacco Tax. New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status. This memorandum explains the Tax Departments existing policy concerning employer withholding on the wages paid to certain.

This tax rate includes New York City and New York State sales taxes as well as. I have already paid 3000. Best of all you wont have to.

Theres also a state and local tax on hotel rooms for inexpensive to moderately-priced rooms. The tax is collected by the New York State Department of. On the other hand many products face higher rates or additional charges.

October 1 2021 The onset of. For instance the sales tax in New York City is currently 8875 while the sales tax rate in New Jersey is 6625. Working In New York City Taxes.

I am being pursued by the New Jersey Division of Taxation to pay taxes from 2015 to 2019 in the amount of 11000. Cigarettes are subject to an excise tax of 435 per pack of 20 and other. Overview of New York Taxes.

You are not double-taxed. Sun Feb 06 2022 in Jobs. The Restaurant Return-To-Work Tax Credit Program incentivized COVID-impacted restaurants to bring.

I work in New York City. The citys tax rates range from 3078 of taxable income to 3876 for top earners. If you are an employer as described in federal Publication 15 Circular E Employers Tax Guide and you.

The tax is collected by the New York State Department of Taxation and. People trusts and estates must pay the New York City Personal Income Tax if they earn income in the City. Who Work 14 Days or Fewer in New York State.

Withholding tax requirements Who must withhold personal income tax. Remote Workers May Owe New York Income Tax Even If They Havent Set Foot in the State By Jennifer Prendamano James Jay M. Yes you will pay taxes in both states if you live in NJ and work in NYC but you wont be double-taxed as you will receive credits for taxes paid.

New Jersey residents who work in New York State must file a New York Nonresident Income Tax return Form IT-203 as well as a New Jersey Resident Income Tax. So if you live in New Jersey and work.

How Much Will I Pay In Income Tax While Working On An H1b In The Us

Us New York Implements New Tax Rates Kpmg Global

Nyc Property Tax Bills How To Find And Read Them Yoreevo

New York Budget Gap Options For Addressing New York Revenue Shortfall

How Much Tax Is Deducted From A Paycheck In Ny Cilenti Cooper Overtime Lawyers In Ny

Should N J Start A Border War And Grab Income Taxes Paid By Nyc Employees Now Working At Home In Jersey Nj Com

What S The New York State Income Tax Rate Credit Karma

Remote Workers May Owe New York Income Tax Even If They Haven T Set Foot In The State Marks Paneth

Solved I Live In Nj But Work In Ny How Do I Enter State Tax

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

Tythedesign Nyc Dept Consumer Affairs Promoting Free Tax Preparation

My Attempt At Nj Area Research To Move Working In Nyc Please Destroy It R Newjersey

Mansion Tax Nyc Pied A Terre Tax New York State Budget

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

N J Could Grab Hundreds Of Millions In N Y Income Taxes Paid By Nyc Employees Now Working At Home In Jersey Nj Com

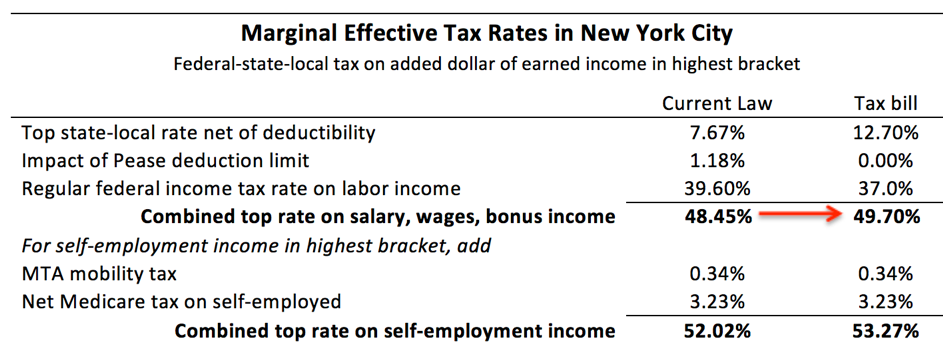

Testimony Fy2020 New York State Budget Taxes Empire Center For Public Policy